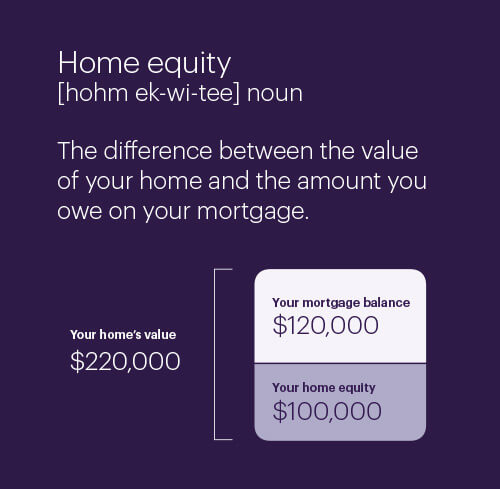

It is a ratio based on the difference between the fair market value of the property and the amount still owed on the mortgage. An Execuline home equity line of credit is a loan which allows you to use the equity in your house to establish an open-end line of credit.

Up to 95 of the current market value of your home less any outstanding mortgage balance subject to.

. Remote and Mobile Deposit Capture. For instance if you plan to. Term Years Amount Borrowed Monthly Payment Total Loan Interest 80 LTV 1st Lien 4.

As of May 2022 interest rates peaked at 530 then decreased slightly to 525. All rates are subject to change without notice. By paying a down payment you are.

Put Your Equity To Work. Ad Make all Your Debt Tax Deductible with a Home Equity Loan Write it Off. Ad Find The Best Home Equity Loan Rates.

Dont Wait For A Stimulus From Congress Refi Before Rates Rise. This table is a list of Money Market Account products the balances required and the earnings. For example say your homes appraised value is 200000.

Refinance Before Rates Go Up Again. Leveraging a new home equity line of credit may be a smart way to stay a step ahead. Ad 249 intro APR for the first 12 months.

Save thousands of dollars in traditional closing costs while getting a great mortgage rate with CapCenter. Equity is your financial interest in your property. A representative monthly payment.

Mortgage Home Loan rates. APRs start at 653 percent in some states. Please note that the interest rates and fees shown here are based on a 40000 loan amount with an LTV.

Ad Compare The Best Home Equity Lenders. A home equity loan lets you borrow money against the value of your homes equity to pay for things like home renovations and college educations or to pay. Capital one offers very competitive rates on home equity loans and lines of credit.

Monthly Fixed-Rate Loans Payment Examples. Before taking out a HELOC you can have your banker use that lifetime cap rate to tell you what your payment could be in a worst-case situation. Apply Pre Approved in 24hrs.

Top Lenders Reviewed By Industry Experts. You receive the full loan proceeds at closing and make fixed monthly payments on the loan for the entire term of the. 3 That 240000 mortgage.

Rates last updated 05112022 1102 AM. Its our job to help make it just a little easier. The first column is the product name.

A traditional home equity loan from Capitol Federal offers. We know you work hard to keep your business thriving. 85 of that is 170000.

Capitol Federals Home Equity Lines of Credit. Ad Put Your Home Equity To Work Pay For Big Expenses. CapCenter offers a wide range of mortgages including conventional jumbo FHA and VA loans.

Rates shown are for a 30-day lock period. We help customers realize their dream of home ownership with competitive mortgage rates for conventional fixed rate loans adjustable rate mortgage loans. Top Lenders Reviewed By Industry Experts.

The Annual Percentage Rate APR shall be set at the time of funding and may be as high as the current Prime Rate plus 2 with a maximum APR of 18. In a conventional loan for instance you can expect to pay mortgage insurance until youve secured at least 20 equity in your home. Money Market Account Rates.

Call our Business Banking. Home equity lines of credit are typically good for a specific term generally 10 to 15 years and sometimes have a draw period that allows you to take money on the loan over time rather. Compare Choose 2022s Home Equity Loan Rates.

Buy a Home. Ad Use Lendstart Marketplace To Find The Best Option For You. You can choose a 10 15 20 or 30.

A home equity loan allows you to access the equity in your home. Ad Find The Best Home Equity Loan Rates. Their lines of credit are variable rate 413 as of this review and they dont involve any.

Assumes a 320000 conventional loan Rates last. Merchant Card Services. Terms range from 10 to 20 years on loans from 10000 to 500000.

If you still owe 120000 on your mortgage youll subtract that leaving you. At 525 it will cost 1325 monthly and accrue 237104 in. The lender also offers mortgage refinancing.

Learn how home equity loans work. Why Flagstar Bank is the best home equity loan for flexible loan terms. As low as 400 variable APR after 12 months.

Ad Call to find out more. Get Lowest Rates Save Money.

Learning Center Penfed Mortgage Payoff Best Mortgage Lenders Refinance Mortgage

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Loan Vs Line Of Credit Clearview Fcu

Infographics By Eli H Han Http Elihshan Com Boost Co Growth Capital Loan Vs Equity Investment Banking Startup Funding Accounting And Finance

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Navy Federal Credit Union

Customer Satisfaction Falls At Big Banks Amid Staffing Challenges Retail Banking Banking Services Banking Industry

Penfed Mortgage Knowledge Center 30 Year Mortgage Mortgage Home Equity Loan

Home Equity Line Of Credit Heloc Home Loans U S Bank

3 Smart Ways To Use Home Equity Truist

Home Equity Line Of Credit Heloc Rocket Mortgage

What Is A Good Used Car Interest Rate 2019 Geographical Situations Havent Happened To Be The Center Of Attention Per Loan Interest Rates Car Loans Loan Rates

Home Equity Loans Home Loans U S Bank

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Home Improvement Loans Home Remodeling Guide U S Bank

Home Equity Line Of Credit Heloc Rocket Mortgage

Homebuying Vs Renting A Cost Comparison 30 Year Mortgage Mortgage Payment Rent

/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)